Working capital is the company’s ability to pay current liabilities with current assets . Working capital is an important measure of financial health because creditors can measure a company’s ability to pay off its debts within a year.

Working capital represents the difference between a company’s current assets and current liabilities. The challenge is to determine the right category based on the large number of assets and liabilities on the company’s balance sheet and outline the company’s overall health in meeting its short-term commitments.

Working Capital Components

Current Asset

This is what companies have today – both tangible and intangible – that they can easily turn into cash within a year or a business cycle, whichever is less. The more obvious categories include demand deposits and savings; highly liquid securities such as stocks, bonds, mutual funds and ETFs; money market account; cash and cash equivalents, accounts receivable , inventory and other short-term prepaid expenses. Other examples include current assets from discontinued operations and interest payable. Current assets do not include long-term or illiquid investments such as certain hedge funds, real estate, or collections.

Current Liabilities

In the same way, current liabilities include all debts and expenses that the company expects to pay in one year or one business cycle, whichever is less.

This usually includes all the normal costs of running the business such as rent, utilities, materials and supplies; payment of interest or principal of debt; accounts payable ; accrued obligations; and accrued income tax. Other current liabilities include dividend payable , leases with maturities in one year, and long-term debts that are due.

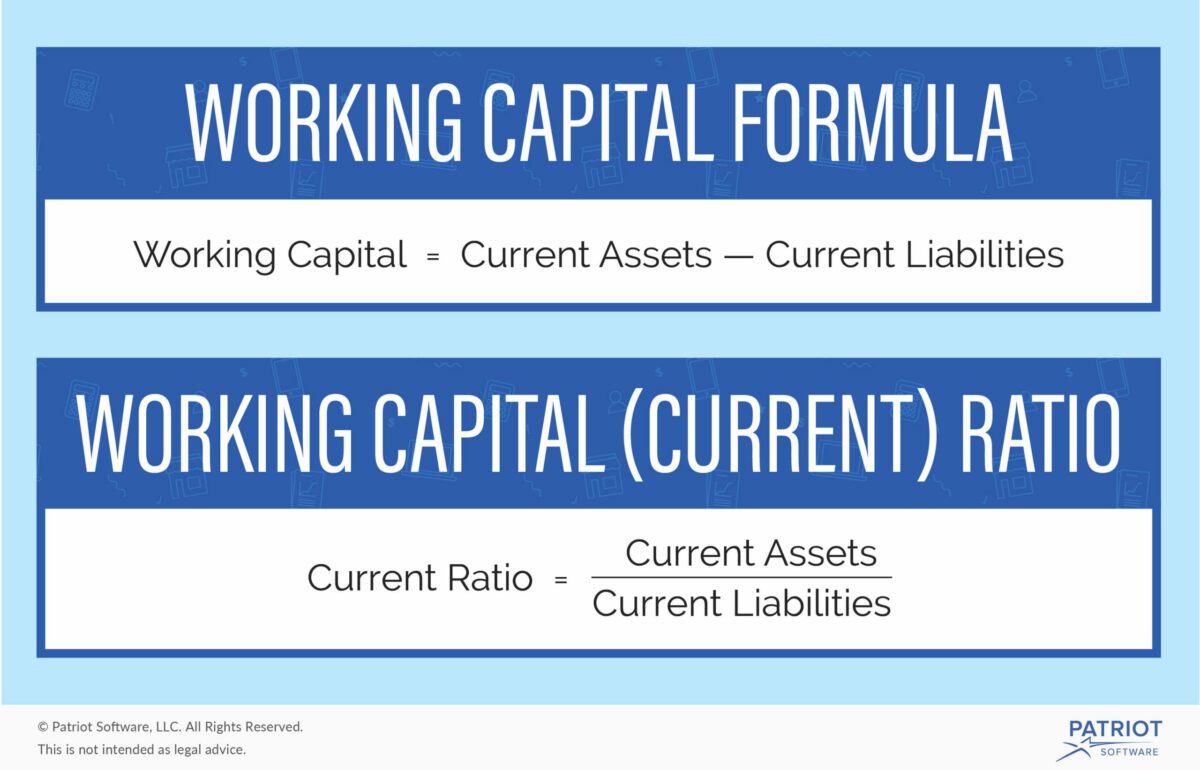

How to Calculate Working Capital

Working capital is calculated using the current ratio, namely current assets divided by current liabilities. A ratio above 1 means current assets exceed liabilities, and generally, the higher the ratio, the better.

Example of Working Capital: Taruna Arka

For the fiscal year ended December 31, 2017, PT Taruna Arka has current assets of IDR 36.54 billion. Includes cash and cash equivalents , short-term investments , marketable securities, accounts receivable, inventories, prepaid expenses, and assets held for sale.

Taruna Arka has current liabilities for the fiscal year ending December 2017 amounting to IDR 27.19 billion. Current liabilities include trade payables, accrued expenses, loans and notes payable, current long-term debt maturities, accrued income taxes, and liabilities held for sale.

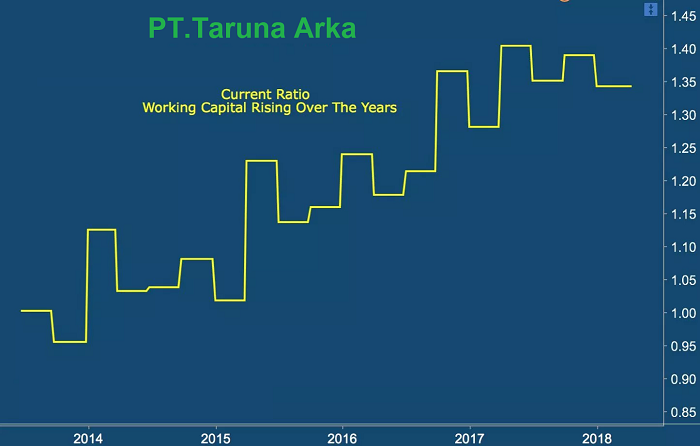

According to the information above, the company’s current ratio is 1.34:

IDR 36.54 billion ÷ IDR 27.19 billion = 1.34.

Has Working Capital Changed?

While working capital funds do not expire, working capital figures do change over time. That’s because the company’s current liabilities and current assets are based on a rolling 12 month period.

The exact working capital figure can change every day, depending on the nature of the company’s debt. What was once a long-term liability, such as a 10-year loan, becomes a current liability in year nine when the payment deadline is less than one year away. Likewise, what was once a long-term asset, such as real estate or equipment, suddenly becomes an asset as buyers line up.

Working capital as a current asset cannot be depreciated (depreciated) like a long-term asset. Certain working capital, such as inventory and accounts receivable, can lose value or even be written off occasionally, but how it is recorded does not follow depreciation rules.

Working capital as current assets can only be charged immediately as a one-time expense to match the income they helped generate in the period.

Although it cannot lose value due to depreciation over time, working capital can be devalued when some assets have to be marked (Mark-to-Market) to the market.

It occurs when the asset price is below its original cost, and the others cannot be saved. Two common examples involve inventory and accounts receivable.

Outdated supplies can be a real problem in operations. When that occurs, the market for inventory has a lower price than the original purchase value recorded in the accounting books. To reflect current market conditions and use the lower cost and market method, companies mark their inventory down, resulting in a loss of working capital value.

Some receivables may become uncollectible at some point and have to be written off entirely, which is another loss of value in working capital. Because losses in current assets reduce working capital below the desired level, funds or long-term assets may be required to fill the shortfall in current assets, an expensive way to finance additional working capital.

Means Working Capital

A healthy business will have sufficient capacity to pay off current liabilities with current assets. A ratio higher than above 1 means the company’s assets can be converted into cash at a faster rate. The higher the ratio, the more likely the company will be able to pay off short-term obligations and debts.

The higher ratio also means the company can easily fund its day-to-day operations. The more working capital a company has means that it may not need to take on debt to finance its business growth.

A company with a ratio less than 1 is considered risky by investors and creditors because it indicates that the company may not be able to cover its debts if necessary. A current ratio of less than 1 is known as negative working capital.

We can see in the graph below that the working capital of Pt. Arka cadets, as indicated by the current ratio, have been increasing steadily over the past few years.

The tighter ratio is the quick ratio, which measures the proportion of short-term liquidity to current liabilities. The difference between this and the current ratio is in the numerator, where the asset side includes cash, securities, and accounts receivable. The Liquid Ratio (Quick Ratio) does not include inventory, which can be more difficult to turn into cash in the short term.

The value of working capital should be assessed periodically from time to time to ensure that devaluation does not occur, because sustainable operations require sufficient working capital.