Amortization is – In accounting you could say that an asset is a resource with economic value that has its own economic value. Assets can also be owned by individuals, companies or countries with the hope that they will be able to provide some benefit in the future.

Even so, there is a condition that causes the value of the purchased asset to be not as fixed as when it was first purchased. The condition for measuring asset values in the world of accounting is commonly known as amortization.

Definition of Amortization

The first thing we will discuss is the meaning of amortization. Although previously explained briefly, at this point will be explained more broadly related to the meaning of amortization.

Amortization is an accounting technique that is usually used periodically to reduce the book value of a loan or intangible asset over a certain period of time. In addition, amortization can also be interpreted as a decrease or reduction in intangible assets for each accounting period that has previously been passed by the company.

The simplest example of amortization is the process of paying monthly bills for vehicle loans, credit card loans and others. The amortization procedure actually has its own method of calculation.

Even so, the distinctive feature of the amortization calculation is that the installment number must be greater than the principal loan and also the interest expense that will be borne by the borrower. With this formula, slowly the amortization value will be paid off in every installment payment process that is made.

Amortization Calculation Method

As previously explained, amortization is a method commonly used to reduce intangible assets in each accounting period of a company. Even so, the amortization calculation process will be carried out haphazardly.

There are specific methods that companies must follow in the amortization calculation process. Basically, the amortization calculation method is already in Law Number 17 of 2000 concerning the third amendment to Law Number 7 of 1983 concerning Income Tax

It should also be noted that each amortization calculation method has different ways of working and benefits. Therefore, the task of the company and the PIC is to understand the needs and financial resources they already have.

The following is an explanation regarding the amortization calculation method which you can read in full.

1. Straight Line Method

The straight-line method is a technique that can be used in amortization calculations. Where the straight-line method will drive a system of cost allocations whose total will be budgeted each year in the same amount. In fact, you could say that the straight-line method is a cost value with a relatively stable amount of depreciation in each accounting period.

2. Declining Balance Method

The declining balance method can also be used as an amortization calculation method. In the declining balance method, the cost allocation system with the budgeted amount will decrease every year as the utilization mass of the asset increases.

In the last year of the useful life there will be a decrease simultaneously with the value of the remaining book. Not only that, in the declining balance method, usually the year the depreciation fee is acquired will be much larger, which in the following year the cost will be even smaller.

The difference between Amortization and Depreciation

Not only amortization, but there is also the term depreciation which relates to the process of reducing the useful value of an asset. Even so, both amortization and depreciation have differences, you know .

If amortization is a decrease in the value of intangible assets, then depreciation is a decrease in tangible assets. Then, amortization shows the value of assets in a company when it will be resold and for depreciation is to allow a company to generate and maintain the existence of income from these assets in a certain period.

Therefore, both amortization and depreciation can be said to have a long-term impact related to the value of a company’s assets. In order to be able to easily manage company assets and be able to measure the value of depreciated assets, you can use an asset management application.

With the help of this particular application, you will find it easier to track asset information in more detail and be able to create an asset value report with the relevant metrics. Of course, this will make it easier for you in the process of managing company assets.

How to Perform Amortization Calculations

Amortization is an activity that requires a company to process debt payments. The debt includes principal repayments as well as interest payments.

The purpose of the principal loan is the forest balance that must be outstanding and must be repaid by the company’s management. Interest payments on these debts will continue to decrease when the principal amount paid becomes greater.

In fact, the longer the amount of interest to be paid also runs out. Even so, the amount of principal payments can actually increase. In order to be effective again, there are about six stages needed in the amortization payment process that can be carried out by a company.

Here are six amortization calculation steps that you can use.

1. Collect Data

The first step a company can take in the amortization calculation process is to collect data. This data will be needed so that the company can start calculating the first amortization. Some of the data that companies can collect is interest rates, loan tenors and loan principal.

2. Prepare Working Papers

After the required data has been collected, the company can start preparing working papers in the amortization calculation process. This working paper is needed so that the amortization calculation process becomes easier to execute.

It is undeniable that advances in technology will also provide convenience for companies in the amortization calculation process. Currently, there are many applications that can be used to perform amortization calculations.

In fact, with the help of Microsoft Excel alone, you can fill in tables with data such as months, principal installment interest, interest installments, installment amounts and loan balances.

3. Determining Loans

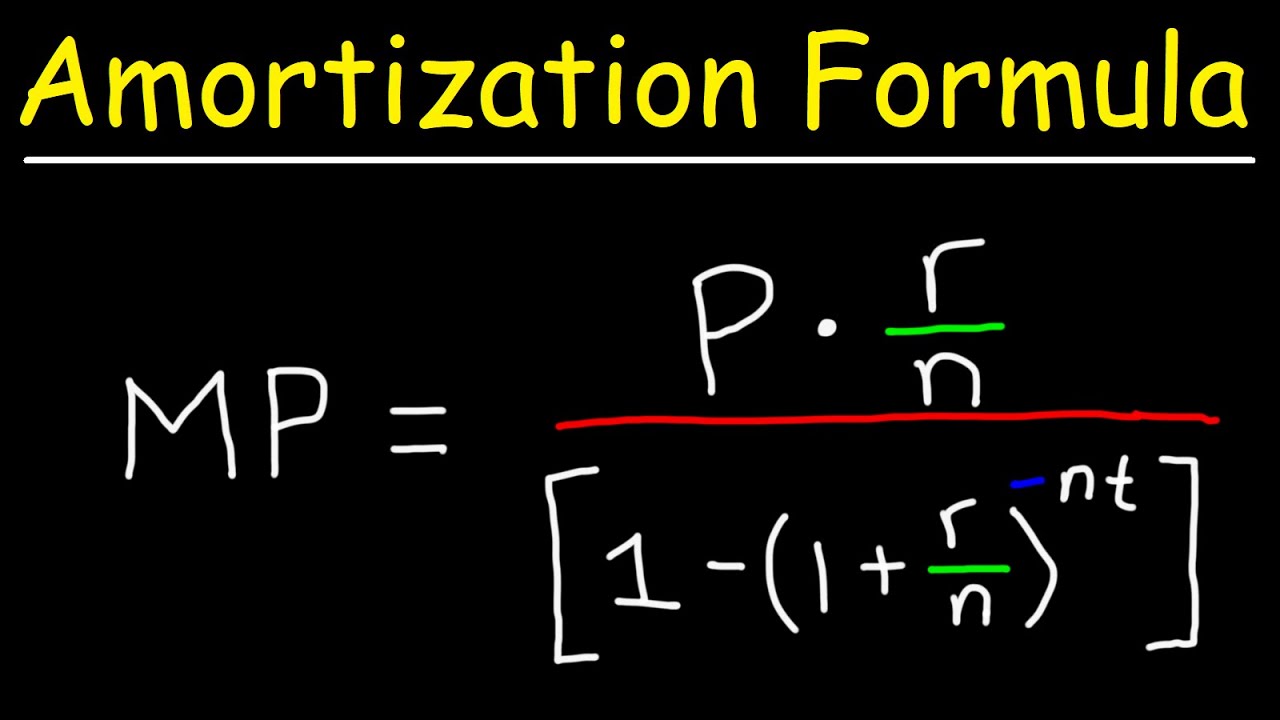

Next is to determine the loan. The company is required to determine the loan in the previous period and calculate the number of existing installments. Meanwhile, the formula used in the process of calculating the company’s installment amount is as shown below.

Installment Amount = P x (i/12) / 1 – (1+(i/12)-t)

Information:

P: loan principal

i: interest rate

t: loan tenor.

4. Perform Interest Installment Calculations

Next is the stage of calculating the amount of interest installments. To be able to calculate interest installments also needed a formula. Below is a formula for calculating interest installments that can be done by the company.

Formula:

The loan principal in the previous month minus the interest rate multiplied by 30/360

5. Identify the installments that must be paid

The next process that can be needed in the amortization calculation is to obtain information related to the principal installments that need to be paid by the company. To make it easier to identify the installments that must be paid by the company, you can use the formula provided below.

Formula:

Total installments – interest installments

6. Perform Loan Balance Calculations

The last step a company can take in calculating the amortization amount is to calculate the loan balance. Just like the previous point, calculating the loan balance also requires a formula. So, the formula used in calculating the loan balance is as follows.

Formula:

The principal amount of the loan in the previous month – the principal installment amount

Those are six easy steps that can be used when you want to do an amortization calculation.

Amortization Benefits

Amortization is an important aspect of business accounting. By using amortization, companies can get a surefire way to be able to predict the financial statements they have.

Not only that, because amortization can provide information to companies related to the debt they have. Interestingly, the existence of amortization is not only able to provide these two benefits, but also has several other benefits as shown below.

- Provide clear information on the amount of payment which includes interest to the principal loan.

- Provides information in the form of debt and interest payment schedules in a more structured manner.

- Provides a tax deduction process in the current tax year.

- Provide clearer and more structured financial report information.

- Reducing the risk of accumulating business debt.

So, those are some of the benefits provided by amortization to a company. With these benefits, amortization is an important aspect required by the company.

Example of Amortization Utilization

As explained if amortization is required by the company. Some examples of the use of amortization are as follows.

- Vehicle loan monthly bills

- Mortgage loans

- KPA loans

- Credit Card Loans

When is the Amortization Calculation Time?

Calculation of amortization of intangible assets can begin in the month of issuance except for certain business fields which are regulated in the Regulation of the Minister of Finance Number PMK 248/PMK.03/2008 as stated below.

- Forestry business sectors such as forest business sector, forest areas and planted forest products that can be carried out in a production process repeatedly and only produce results after the planting process is more than one year.

- The tree plantation business sector is like the plantation business sector where the plants can be produced repeatedly and only produce after the planting process has been more than one year.

- Livestock business sectors such as the livestock business sector where livestock can be produced repeatedly and can only be sold after maintenance has been carried out for at least one year.

Amortization of expenditures to acquire intangible assets and other expenses for certain business fields begins in the month of commercial production or the month in which sales have already started.

Overview of Depreciation

The previous explanation has been explained regarding the difference between amortization and depreciation, both of which provide calculations for assets but in different forms. At this point, we will study more broadly related to depreciation.

Depreciation is a method of depreciation in accounting that can affect the value of a company’s assets, especially fixed assets. The more the decline in the value of fixed assets, then this will be able to lower the selling price of the asset.

Meanwhile, the fixed assets themselves are fixed assets that refer to long-term assets and are useful for the company to be able to carry out its business operations. Buildings, factories, tools, production machines and transportation equipment such as cars and motorbikes are examples of fixed assets. However, land is an exception, because land value cannot be counted as depreciation. This is because land assets will have a higher value over time.

Depreciation or depreciation can have an effect on the value of fixed assets because it can reduce the value on the balance sheet due to depreciation. This can also affect net income because it is considered a cost and also an expense in finance.

Please note that the calculation of depreciation is only applied to tangible fixed assets. Intangible fixed assets such as trademarks, licenses, copyrights, franchises and others are not included as fixed assets that can be calculated in depreciation.

So why is the calculation of the depreciation value so important for the company?

This is related from various aspects. If we do not calculate the depreciation value, it will allow a loss for a company. Losses that might occur are in inappropriate taxes or can be much larger than recording non-decreasing profits in the absence of calculating depreciation or depreciation costs.

Factors Affecting Depreciation

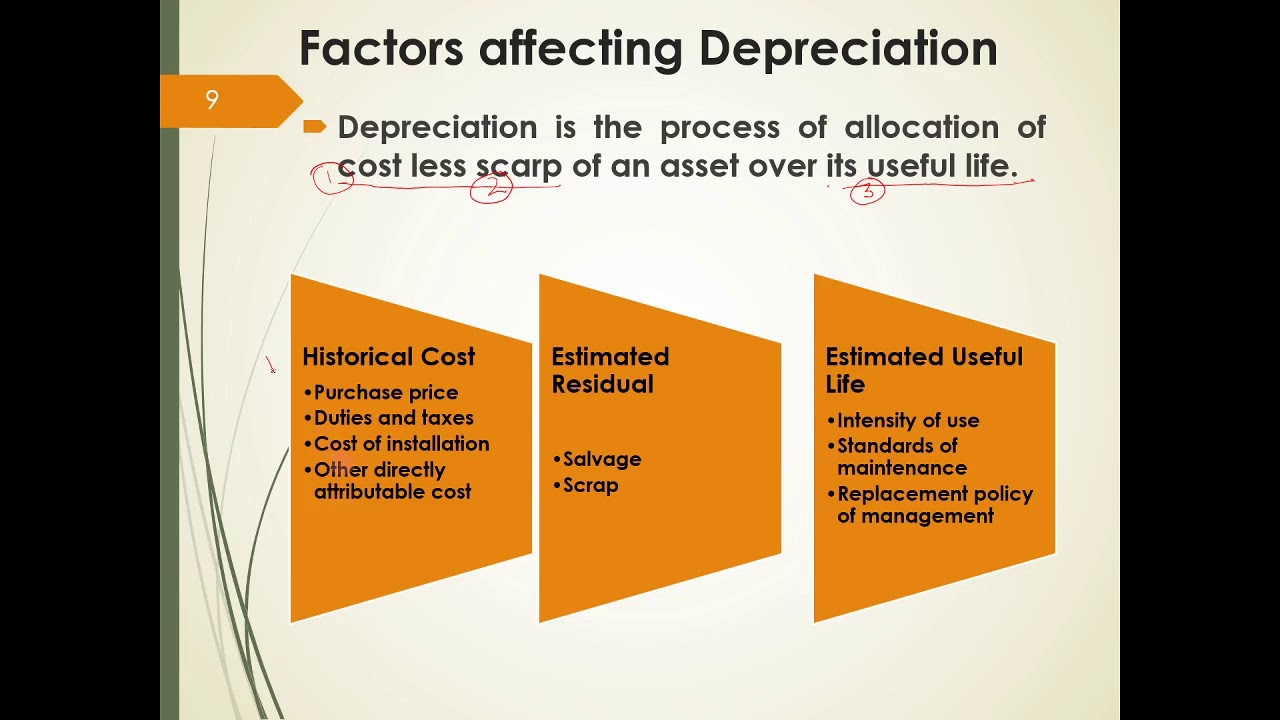

Depreciation or depreciation of the value of tangible assets in a company can also be influenced by several factors. Well, several factors that can affect the value of an asset are as follows.

1. Acquisition Cost Factor

The amount of funds obtained is the basic cost of calculating the amount of depreciation which will later be allocated per certain accounting period. These costs are the main factor that can determine how much depreciation of fixed assets occurs. Costs included in the cost of acquisition are such as the purchase price of the asset, shipping or transportation costs as well as entry and installation costs.

2. Estimated Economic Age

After knowing the acquisition cost. Next is to find out the estimated economic life of each fixed asset. The economic life factor of an asset is also included in the list of factors that can affect the depreciation of an asset.

Estimates of economic life can be known from estimates of how long a tangible asset can be useful in the operational production process. For example, for how long, it can range from months or years to a decline in production quality.

A smaller depreciation will have a longer life. Whereas when there is a greater depreciation, the economic life of the asset will be classified as shorter. Therefore, it is very important for a company to know the estimated economic life of an asset from the start.

3. Estimated Residual Value

The final determining factor for depreciation calculations is the estimated residual value of an asset. The value that can be realized when an asset will be sold or no longer used again is the residual value.

Not only that, residual value can also be interpreted as the residual value of an asset resulting from sales, leasing or rotation in accordance with the maintenance of business policies. Even so, if a fixed asset cannot be used anymore because it cannot provide benefits again, then the asset does not have a residual value that is too high.

So, that’s a review of amortization and a glimpse of depreciation, which you can read in full here. After reading this article to the end, I hope all the discussion will be useful for Sinaumed’s.

If, you want to find various kinds of books about accounting, then you can find them at sinaumedia.com . To support Sinaumed’s in adding insight, sinaumedia always provides quality and original books so that Sinaumed’s has #MoreWithReading information.