Often Confused What is the difference between Revenue and Income? Here’s the explanation – Without realizing it, usually some financial terms are very often misused in everyday conversation.

The wrong use of the word sometimes causes confusion for young investors and early entrepreneurs.

Especially entrepreneurs and investors who do not have a formal basic education about finance.

One term that is very familiar to hear, but is still very gray in its meaning is revenue and income.

Most people very often use these terms interchangeably, but sometimes in the wrong context. This term does sound very similar, even from its meaning, but it turns out to be different in the concept of meaning.

Definition of Revenue

Revenue, a word that will usually always appear at the very top of the operating income statement. Usually this consists of the total amount of cash generated through the sale of a product or service which is the main operational act for a business.

The results of the revenue displayed are usually also reduced by existing returns or discounts. In other words, revenue can be explained as the net profit generated by business people in a certain period.

For example, if you own a food business, your revenue will come from total food sales over a certain period of time (usually calculated on a monthly basis). If you give a discount, then you can subtract the resulting count from the total discount you provide to consumers.

Apart from that, sometimes some types of businesses may also have alternative sources of income either from investments or the sale of other assets. This fund cannot be counted as revenue because it does not come from the main operations of a business.

You can enter the total funds generated outside of the main operations into other sections of the income statement.

Definition of Income

Income or what is commonly called income or profit earned, turns out to have a different meaning from revenue. In the financial context, income almost always refers to net income.

It is usually referred to as net income because the amount can represent the total amount of cash remaining from the original amount of income after taking into account all additional costs and revenues that exist.

Existing costs include cost of goods sold, operating costs such as rent, utilities, salaries, interest paid on debt, depreciation and amortization costs, tax costs; emergency expenses due to extraordinary events such as lawsuits.

As for additional income, it usually comes from several incomes including interest accumulated on investments or funds originating from the sale of intangible assets or physical assets, such as equipment or bonds.

For example, if you own a restaurant that generates a net profit of IDR 2,000,000 per day, then in one month you will have IDR 2,000,000 x 30 = IDR 60,000,000 net profit in a month.

Then you need to pay a rental fee of 5 million per month, raw material costs of Rp. 10,000,000 per month, along with the cost of employees for 5 people, each of which is Rp. 2,000,000 per month.

If totaled; IDR 5,000,000 + IDR 10,000,000 + IDR 10,000,000 = IDR 25,000,000. Then you can subtract the revenue earned by the costs incurred. So Rp 60,000,000 – Rp 25,000,000 = Rp 35,000,000.

The total number generated is what we then refer to as income or net profit obtained through a business being run.

This figure can then be added with several other alternative sources of income as well as a form of income that can be received by a business owner.

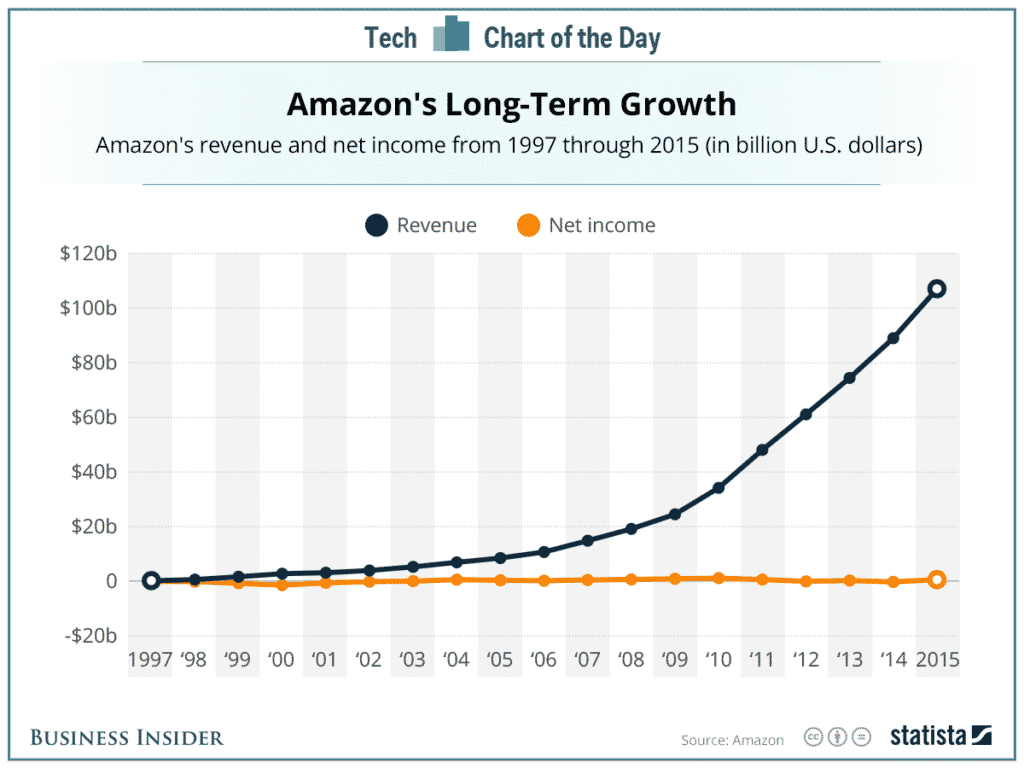

Revenue & Income Difference in Pictures

Do you understand the difference between revenue and income ? If you’re still confused, here’s an image from Amazon’s 2015 financial report.