In the previous material, we have studied the definition of inflation, its triggering factors, and economic policies to overcome it. In this article, we will study the situation opposite to inflation, namely negative inflation or deflation and its impact on the economy.

1. DEFINITION OF DEFLATION.

In principle, deflation is a general decline in output prices . This situation is actually a common thing in the economy.

It should be noted that when the price decline lasts only for a moment, it cannot be said to be deflation.

Likewise, when price declines only occur in certain sectors even though they last for some time, as long as they do not have an impact on the aggregate economy, it cannot be said to be deflation.

Therefore,a deflative situation has the potential to harm the economy if a general decline in prices occurs over a period of time (some literature mentions at least 1-2 quarters), and is reflected through a decline in the consumer price index (CPI) or GDP deflator .

The decline in prices could be caused by several factors , including:

- productivity increase .

- application of modern technology .

- policy changes , for example through regulatory deregulation.

- decrease in the price of input goods .

- excess capacity ( excess supply ).

- weak demand .

If the deflation that occurs is caused by points 1 to 4, what usually happens is mild deflation ( benign deflation ) which does not pose a threat to the economy , because falling prices tend to be followed by an increase in economic growth.

The simple explanation:

- when modern technology is applied to increase productivity, it will result in cost and time efficiency . This efficiency will cut production costs and operating costs , thereby lowering the selling price of output that must be borne by consumers.

- in turn, this situation will trigger an increase in consumption (an increase in the quantity of output sales), as well as encourage an increase in economic growth . This also applies if there is a deregulation policy that encourages productivity growth.

It is different if the price decline lasts for a long time and causes the CPI and GDP deflator to become negative , then this situation has the potential to harm the economy (a deflative situation like this is known as a malign deflation ).

The explanation is simple:

- when prices have decreased for some period of time, consumers and investors will hold liquidity (choose to hold money), in the hope that prices will continue to decline in the future.

- on the other hand, when supply exceeds demand for a long time, this results in a decrease in profit, an increase in input costs, and an increase in unemployment .

One case of deflation was the economic crisis in the United States in the 1930s (the Great Depression ), where output prices fell by about 25%, real GDP fell by 30%, and the unemployment rate rose sharply to 25% (Brooks, Douglas H. ., and Pilipinas F. Quising. Danger of Deflation , Asian Development Bank, ERD Policy Brief No. 12, December 2002).

2. ECONOMIC VIEWS ON DEFLATION.

In this section we will summarize some of the economists’ views on deflation.

2.1. The view of the monetarists.

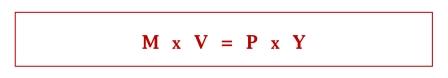

The monetarist’s point of view is the money supply – side cause . The occurrence of deflation can be described by the following equation:

description:

- M is the money supply ( money supply ).

- V is the velocity of money circulation .

- P is the price of output, which also indicates the size of the GDP deflator.

- Y is the quantity of output, which also shows the size of real GDP.

- (Remember! In the previous lesson we learned that the GDP deflator = Nominal GDP / Real GDP. This means P x Y = Nominal GDP).

The explanation is as follows:

- If real GDP is held constant in the short term (recall material Three Model Approaches in the Study of Macroeconomics), a decrease in M or V through tight monetary policy, will result in a decrease in the GDP deflator or inflation rate .

- when the decline in the inflation rate continues to below zero , then deflation occurs .

- For the record: tight monetary policy ( contractionary monetary policy ) is the central bank’s policy by reducing the money supply (M), or increasing the benchmark interest rate (i).

The monetarists suggest the implementation of expansionary monetary policy ( expansionary monetary policy ) , for example by increasing the money supply through the purchase of financial assets (bonds). This policy is also known as quantitative easing .

2.2. Irving Fisher’s Perspective (Fisher’s Effect).

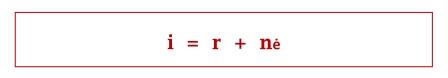

The deflative situation can also be explained by the Fisher effect, where:

description:

- i is the nominal interest rate ( nominal interest rate ).

- r is the real interest rate ( real interest rate ).

- nē is the expected inflation ( expected inflation ).

The explanation is:

- when consumers and investors still view the continued decline in prices in the future, this will result in a decrease in expected inflation as well as a lower nominal interest rate .

- at that time, consumers and investors tend to choose to hold liquidity rather than spending on consumption or investment. This is what triggers deflation.

2.3. The Keynesian View.

The Keynesians view that deflation occurs because of a decrease in aggregate demand ( demand-side cause ) (note: remember the equation Y C + I + G + NX, this equation will often be found in subsequent materials; and given the large number of materials related to aggregate demand , then the review will be presented in a separate article).

According to Keynesians, deflation is associated with an increase in unemployment, a decrease in profits and income , and the emergence of debt defaults .

One of the important focuses of the Keynesian perspective is the theory of the liquidity trap ., where the addition of liquidity by the central bank is not able to raise interest rates and income , and encourage economic growth .

In modern macroeconomic concepts, the liquidity trap is a situation where the nominal interest rate is zero . So if the interest rate is zero , then consumers and investors prefer to hold cash rather than invest (for example in bonds) with a 0% profit rate .

This at the same time argues against the view of monetarists, stating that monetary policy is not effective in overcoming deflation .

To answer this question, Keynesians suggest implementing a fiscal-stimulus policy (Eurobank Research. Is Deflation a Risk for Greece? , Economy & Markets, Vol IX, Issue 3, April 2014).

This is an understanding of deflation and its impact on the economy. **