Top 10 Banking Applications

In today’s fast-paced world where everything is just a click away, banking has also gone digital. Banking applications are a great way to save time and make banking easy. With so many banking applications in the market, it is challenging to choose the best ones. In this article, we have compiled a list of the top 10 banking applications in 2021.

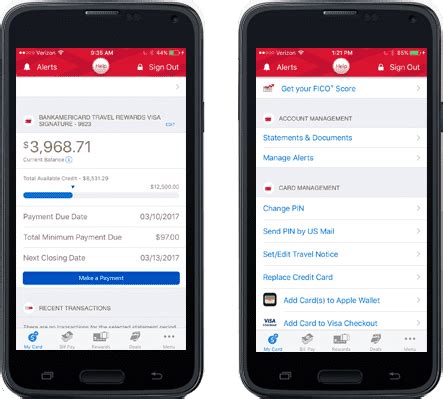

1. Bank of America Mobile Banking

The Bank of America Mobile Banking app is a widely used banking application. It has excellent features like managing bank accounts, credit, and debit cards. The app also allows you to deposit checks remotely, transfer funds, and track account activity. The app has a user-friendly interface that makes banking easy and offers high-level security features.

2. Chase Mobile

Chase Mobile is another popular banking application. It allows you to manage your bank accounts and credit cards, transfer funds, and deposit checks remotely. The app has a user-friendly interface and offers high-level security features like fingerprint and facial recognition. One of the unique features of the app is the ability to schedule payments to payees.

3. Capital One Mobile

The Capital One Mobile app enables you to manage your bank accounts and credit cards, deposit checks remotely and transfer funds. The app has high-level security features and the ability to check balances on-the-go. It also offers a unique feature called CreditWise, which helps you monitor your credit score and report.

4. Wells Fargo Mobile

Wells Fargo Mobile is an easy-to-use banking application that allows you to manage your bank accounts, credit cards, and investment accounts. You can also transfer funds and remotely deposit checks. The app has high-level security features and the ability to view and pay bills. Additionally, Wells Fargo Mobile offers a unique feature that allows you to use your fingerprint to access the app.

5. Ally Mobile

Ally Mobile is a popular banking application that enables you to manage your bank accounts, invest, pay bills, and deposit checks remotely. The app has a user-friendly interface and the ability to view all your transactions. Additionally, Ally Mobile offers high-level security features like fingerprint login, facial recognition, and two-factor authentication.

6. Simple

Simple is a banking application that allows you to set goals for savings and track them. The app has a unique Safe-to-Spend feature, which tells you how much money you have available to spend based on your bills and savings goals. You can also deposit checks remotely and transfer funds. The app has high-level security features and a user-friendly interface.

7. USAA Mobile

USAA Mobile is a banking application that is exclusively available to US military personnel and their families. The app allows you to manage bank accounts, credit cards, investment accounts, and insurance policies. You can also deposit checks remotely and transfer funds. The app has high-level security features that are certified by the Federal Financial Institutions Examination Council (FFIEC).

8. Citi Mobile

Citi Mobile is a banking application that allows you to manage your bank accounts, credit cards, and investment accounts. You can also deposit checks remotely and transfer funds. The app has high-level security features like Touch ID and facial recognition. Additionally, the app offers the ability to pay bills and view statements.

9. PNC Mobile

PNC Mobile is a banking application that allows you to manage your bank accounts, credit cards, and investment accounts. You can also deposit checks remotely, transfer funds, and view transactions. The app has a user-friendly interface and high-level security features. Additionally, PNC Mobile offers the ability to pay bills and track spending.

10. TD Bank

TD Bank is a banking application that allows you to manage your bank accounts, credit cards, and investment accounts. You can also deposit checks remotely, transfer funds, and schedule payments. The app has a user-friendly interface and high-level security features. Additionally, TD Bank offers the ability to pay bills and view statements.

Conclusion

Banking applications are a great way to save time and make banking easy. With so many banking applications in the market, it is challenging to choose the best ones. The above-listed banking applications are the most popular and have excellent features like managing bank accounts, credit, and debit cards, depositing checks remotely, and transferring funds. These apps offer high-level security features, a user-friendly interface, and unique features like scheduling payments and tracking spending.

Frequently Asked Question

1. What is a banking application?

A banking application is software designed to enable account holders to perform various banking transactions from their mobile devices or computers.

2. Is it safe to use a banking application?

Yes, it is generally safe to use a banking application provided it is downloaded from a reputable source, and the user follows proper security protocols when using it.

3. What type of transactions can I perform with a banking application?

With a banking application, you can perform basic tasks such as checking your account balance, making transfers, and paying bills. Some applications also allow you to apply for loans and set up standing orders.

4. Can I link multiple bank accounts to a single banking application?

Yes, most banking applications allow you to link several bank accounts, provided they are with the same financial institution.

5. How can I download a banking application?

You can download a banking application from your mobile device’s app store or the financial institution’s website.

6. Do I need to pay any fees for using a banking application?

Typically, using a banking application is free of charge. However, some financial institutions may charge fees for specific transactions such as international transfers.

7. How do I ensure my online banking information is secure?

To ensure your online banking information is secure, you should use strong passwords, avoid using public Wi-Fi networks, and regularly check your transaction history.

8. Can I use a banking application without an internet connection?

No, you must have an active internet connection to use a banking application.

9. What should I do if I lose my mobile device with the banking application installed?

If you lose your mobile device with the banking application installed, you should contact your financial institution immediately to disable the application and prevent unauthorized access to your account.

10. What happens if I forget my login credentials for the banking application?

If you forget your login credentials for the banking application, you can use the password reset feature or contact your financial institution for assistance with regaining access to your account.