Musyarakah is an important contract in Islamic economics, which is increasingly recognized by residents in Indonesia. As adherents of Islam continue to understand the importance of muamalah, especially in the economic aspect, they are turning to contracts that are permissible in Islamic law.

Among the various contracts used in Indonesia, musyarakah, mudharabah, and murabahah are the most widely used, with musyarakah being an important contract in Islamic banking services. As the lifestyle of the public changes, Islamic banking services are becoming more popular and musyarakah is one of the contracts that offers products to customers.

In this article, we will discuss the musyarakah contract in more detail, and Sinaumed’s friends can follow along to learn more about it. By understanding the musyarakah contract, we can better navigate the world of Islamic economics and make informed decisions in our financial transactions.

Definition of Musyarakah Contract

Musyarakah, also known as Syirkah or Syarikah, means partnership or cooperation in English. It is a type of contract used in Islamic banking, where two or more parties collaborate to achieve a specific mission in the field of business. Each party has an equal share in the business according to their capital contribution and has the right to monitor (voting rights) in the industry according to their respective proportions.

In the Sharia Economic Law Group, Syirkah is defined as a collaboration between two or more people in terms of investment, expertise, belief in a special endeavor, with an allotment of profits sourced from family relationships. The DSN-MUI teachings define Musyarakah as financing based on a cooperation agreement between two or more parties for a special undertaking, where each party contributes a budget with the determination that profits and risks will be guaranteed together according to the agreement.

Islamic banking interprets Musyarakah as a financing product based on the principle of loss sharing profits in the form of aggregation of capital of the parties with the mission of having a heritage, effort, or special blueprint. The profits and risks are determined according to the agreed contract and split based on family relationships for the results agreed upon in the contract.

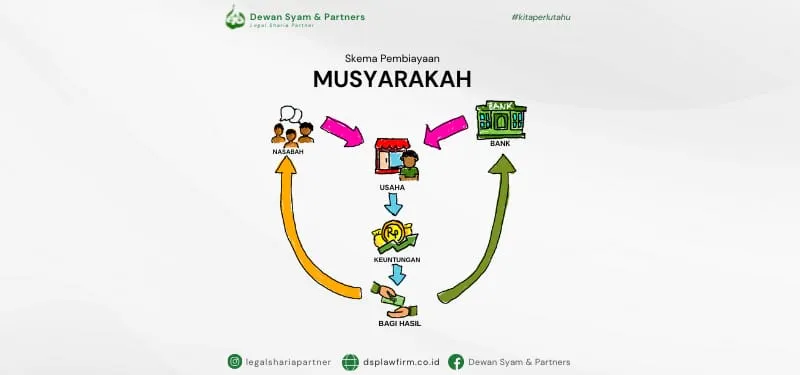

In the musyarakah platform product financing agreement between the investor, in this case, the bank, and the customer, both investors deposit capital according to the ratio. Profits received from projects or efforts are distributed according to the share of capital participation (family relations) between the bank and the customers.

In conclusion, musyarakah is an important concept in Islamic economics and banking, where it allows for collaboration and partnership in business endeavors while adhering to the principles of Islamic finance.

The difference between a Musyarakah

Contract and a Murabaha Contract

In addition, it is important for Sinaumed’s to understand the differences between a musyarakah contract and a murabaha contract. By doing so, they can better distinguish between the two and deepen their understanding of each. Below are some key differences between musyarakah and murabaha contracts.

Musyarakah contract

- Collaborative activity or association between two or more parties. Both

participating parties contributed in the form of budget and resources. - Enter into the type of blending blessing presence of similar activity method formed.

- Profits come from early agreements. Moreover, cooperation in carrying out

blueprints or business fields has uncertain income levels. - Losses are shared based on the included capital ratio.

Murabahah contract

- Derived from the word rabahah which means profit or profit. In murabaha,

buying and selling activities take place either in cash or in installments which of the buying and

selling activities generate profits for the trader. - Enter the type of alteration because there is a difference between objects and money.

- The special advantage is received by the trader while the consumer gets a profit in the form

of object ownership. - Losses occur when consumers are unable to pay installments. For this

reason, it is necessary to have an agreement between the seller and the consumer to give up the

consumer’s inability to pay or the consumer to resell the object purchased where the excess is made into

debt by the consumer.

Pillars and Terms of the Musyarakah Contract

To do musyarakah, it is also necessary to understand its pillars. The following are the

pillars of musyarakah.

- Contract actors, business partners

- The subject of the contract is capital (mall), activities (drabah)

- Shighar, namely Offer and Acceptance

- Family relationship profit (for the results).

In addition, there are certain terms related to Musyarakah that are important to consider.

For Hanafiyah, the terms related to Musyarakah can be broken down into four parts. The first part relates to all forms of Musyarakah with wealth or others. It is important that what coincides with the goods being contracted must be accepted as a representative. The second provision is that the profit allotment must be real and recognized by both parties. The second part relates to Musyarakah with plaza (wealth), where issues such as the type of capital used and the amount must be addressed. The third part relates to Mufawadhah Syirkah, which requires that the capital be the same and that those who are experts in Syirkah for Kafalah. The fourth part is related to the subject of the contract, which requires an ordinary Syurkah for various buying and selling or trading.

For Malikiyah, the conditions related to the person carrying out the contract are independence, puberty, and intelligence. Shafi’iyah, on the other hand, believes that only Inan Syirkah is legally stipulated, and the other types of Syirkah are delayed.

To ensure the validity of a Musyarakah contract, certain conditions must be met, such as the habitat being able to be represented according to the permission of each party, the profit allotment percentage being known from the beginning, and the rationing of profits being determined as a percentage.

Types of Musyarakah Contracts

Broadly speaking, musyarakah is categorized into two types, namely ownership musyarakah (shirkah al amlak), and contract musyarakah (shirkah al aqad).

- Shirkah Amlak

- Syirkah endeavor

- Syirkah ikhtiyar (sincere)

- Syirkah jabar (insistence)

- Shirkah al Aqad

- Tasarruf who is the subject of the syirkah contract must be represented.

- The profit that is obtained is joint ownership which is divided according to the agreement.

- Top down, so that each musyarakah body has authority over other syndicate bodies to carry out tasarruf.

- The profit share for each musyarakah body must be clearly defined.

- Compulsory profit is a part that is owned jointly, not by determination.

Types of Shirkah al Aqad

- Shirkah inan

- Shirkah wujuh

- Shirkah mufawadah

- Shirkah mudharabah

- Shirkah inan

- A cooperation contract between 2 or more people with the body (body) or assets of both of which they already know even though they are not the same.

- Most profits are intended for the most contract executives.

- Shirkah wujuh

- A contract between 2 or more people who have a good name, good prestige and are experts in the field of business, without the involvement of capital.

- Profits can be shared by both.

- Shirkah mufawadhah

- A cooperation contract between 2 or more people.

- Each party has participation in distributing equal shares, both in capital, responsibility and voting rights.

- Shirkah mudharabah

- An agreement between the owner of capital (shohibul mall) and a worker (mudharib), to manage money from the owner of capital in a particular trade whose profits are divided according to a mutual agreement.

Advantages and Disadvantages of Musyarakah

In this final discussion, let us look at the advantages and disadvantages of musyarakah.

Advantages:

- Profit: The distribution of profits is agreed upon and cannot be altered during the capital duration. Profit sharing can be tiered, depending on the agreement between the parties. Profit sharing can be done using the profit and loss sharing method or revenue sharing method, based on the financial information of the customer.

- Risk sharing: Banks and customers share losses according to their respective capital ownership. In cases of loss due to dishonesty, negligence, or breach of contract, the loss is divided based on the ratio of each party’s capital ownership.

Disadvantages:

- Lack of control: Each party does not have complete control over the business, as decisions are made through mutual agreement.

- Shared profits: Profits must be shared with other parties, which may reduce the overall profit received.

If you are considering entering into a musyarakah contract, it is advisable to seek the advice of an expert to avoid mistakes or regrets in the future. You can also refer to books on contract transactions in Islam to learn more about musyarakah.